Stay Compliant: Dh10,000 Fine for Late Corporate Tax UAE Registration

In a recent statement, the Ministry of Finance underscored the importance of timely registration for Corporate Tax UAE. Companies failing to register within the specified deadlines will now face an administrative penalty of Dh10,000. This fine applies to businesses neglecting to submit their Corporate Tax registration applications within the mandated timelines set by the Federal Tax Authority.

The Ministry’s announcement aims to incentivize taxpayers to adhere to tax regulations and register promptly. This penalty mirrors the consequences imposed for late registration of excise tax and value-added tax, ensuring consistency across tax compliance measures.

Today’s announcement builds upon Cabinet Decision №10 of 2024, which brings about amendments to the schedule of violations and administrative penalties outlined in Cabinet Decision №75 of 2023. The latter decree delineated administrative penalties prescribed by the Federal Tax Authority (FTA) concerning infringements on implementing the UAE Corporate Tax Law, enacted as of August 1, 2023.

Effective March 1, 2024, these amendments will enforce a newly introduced fine, reinforcing the significance of timely compliance with Corporate Tax UAE regulations.

For more information and assistance regarding Corporate Tax UAE registration, visit our website or contact our team today.

Stay informed. Stay compliant.

Conclusion:

As businesses navigate the landscape of tax compliance in the UAE, staying abreast of regulatory changes and meeting deadlines for tax registration is paramount. The announcement of a Dh10,000 fine for late registration of Corporate Tax UAE underscores the government’s commitment to enforcing tax regulations and incentivizing timely compliance. By ensuring prompt registration, businesses can avoid penalties and contribute to a transparent and efficient tax ecosystem in the UAE.

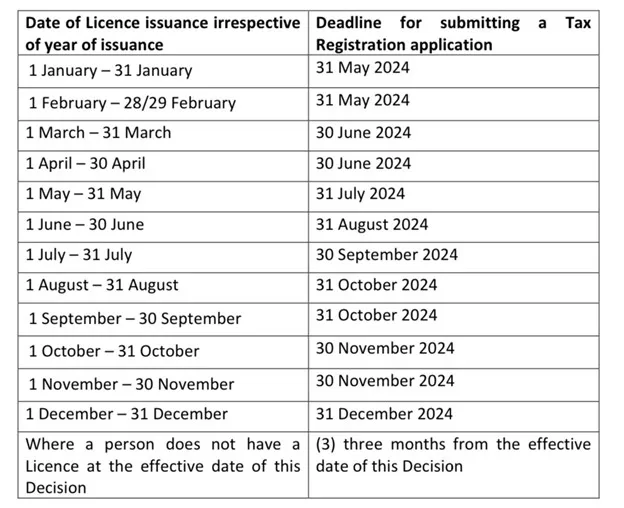

Deadline For Submitting a Tax Registration Application.